Do this task at your own peril! How cyber scamsters are looting people with a new strategy

Here is a look at how these latest cyber scams work in which, investigators say, scamsters exploit what is known as the “Sunk-Cost fallacy”, like in many other cyber scams.

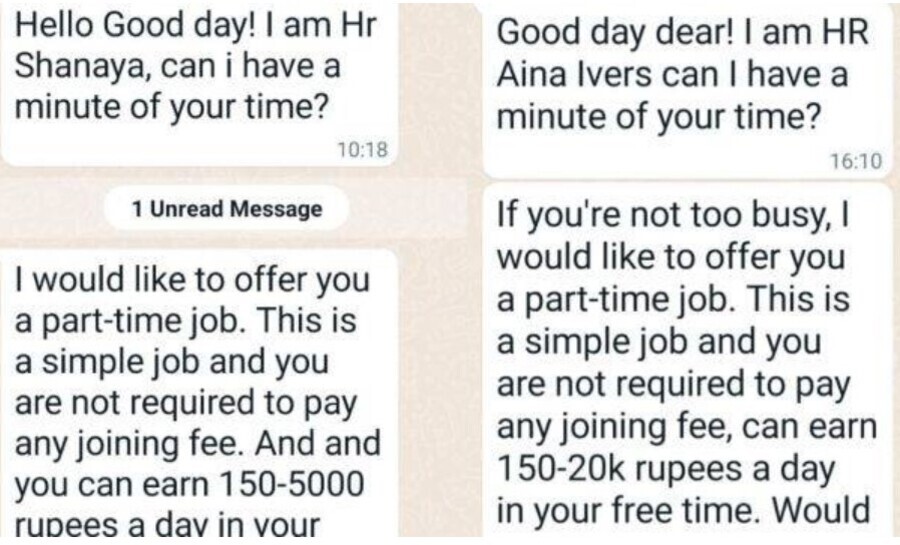

“Good Day Dear! I am HR xxx…I would like to offer you a part time job,” reads a message on the WhatApp received from an international number.”

Another message sent with a different name “HR xxx” reads, “You can earn rupees here by liking YouTube videos and sending screenshots.”

Pune’s cybercrime investigators say these messages are the gateways to elaborate online frauds, being termed as “task frauds” by them.

Here is a look at how these latest cyber scams work in which, investigators say, scamsters exploit what is known as the “sunk-cost fallacy”, like in many other cyber scams.

“Our investigation suggests that a large number of citizens are receiving these messages. It is like the cyber criminals are spreading their fishing net and then waiting for the targets to get caught.

So what is this scam?

Inspector Chandrashekhar Sawant, from the Pune City Cyber Crime police station, who is probing multiple task fraud cases, said, “It starts with a message on WhatsApp, generally from international numbers.

In most of the cases the first message is from a scamster posing as HR representatives offering part-time jobs with good income. After a response from the receiver, they ask you to do tasks like liking YouTube videos, giving reviews of hotels, giving good ratings to online products, etc., and sending them screenshots. For every small task, the scamsters send you amounts like Rs 50, 100 per task.

Once the target is lured, the scamster moves to the next stage. Now they add the target to a Telegram group for what they call prepaid tasks. If the targets do not have a Telegram app on the phone, they ask them to install it or help install it.”

Inspector Sawant said, “On Telegram, they make you believe that you have been promoted a level by adding you to Telegram groups of names suggesting a step above.

It is at this stage that the scamsters start demanding money on the pretext of what they call prepaid tasks. Now they ask, for example, Rs 1,000 before a task, and then pay you back Rs 1,300 or Rs 1,500 after the task is complete. Here, the nature of tasks changes but does not go beyond the target requiring to just click, like or rate things.

They then add the target to another higher level group where the value of prepaid tasks goes into lakhs. They seek, for example, Rs 2-3 lakh and promise higher returns.”

Now comes the twist in the tale.

“At one stage, they stop giving back the returns on these prepaid tasks using various pretexts — like further investment of those amounts into bitcoins or saying that there are issues with the payments. To return the money paid earlier, scamsters start demanding more and more money and in larger amounts. Expecting to recover the money after investing so much, the victims continue to pay up. As victims stop further payments and start demanding back their money after realising that they are being cheated, the scamsters close the communication channels and go incommunicado. In most cases, none of these communications are over calls, it is just texts on messenger apps,” Sawant said.

“The shift to Telegram from WhatsApp is for a reason. While WhatsApp generally shares with police entities the information about their users for investigation purposes, Telegram hardly ever responds to such requests,” another officer said.

Senior Inspector Minal Patil said, “The underlying broad method of the scam is similar to any other cyber fraud where the vulnerabilities of the victims are exploited by the criminals into making them pay money. Only the method of luring the targets and the pretexts of scamming have changed. We have launched coordinated probes into the multiple cases that we have reported over the last three months.”

A senior cyber investigator said, “There is a concept in behavioural economics termed as sunk cost fallacy where a person continues to invest in endeavours in spite of serious doubts of failure, especially because the person has already invested so much in it. They also exploit vulnerabilities like need, greed, fear and lack of application of common sense and logic in most cases.”

The Indian Express came across at least 12 such instances over the past three months, with several cases registered over the past one-and-a-half months. Consider some of the key cases:

* An Army veteran, in his 60s, who responded to scamsters who contacted him in February, lost Rs 1.1 crore in a span of two weeks where he made as many 26 online transfers to over a dozen bank accounts.

* Between February and April, a business analyst with an IT company, who is in her 40s in Pune, lost Rs 47 lakh to a cyber fraudster. She made 18 online payments eithers on to bank accounts or to online payment platform accounts.

* An engineering professional in his late 20s lost Rs 9 lakh over 19 transactions after he started responding to a message from “HR Meera Mehta”.

* A doctor from Pune, who is in her early 50s, lost over Rs 23 lakh to cyber criminals after she fell prey to the money for task lure.

* This month, a 40-year-old engineer from Pimpri Chinchwad fell prey to the similar scam and lost Rs 57 lakh.

“What baffles us the most is the victims of these scams who have lost amounts ranging from Rs 10 lakh to over Rs one crore, are of strong educational backgrounds. Many even have technology and software degrees. And in spite of reporting of these cases across the media, people continue to fall prey to these scamsters,” said Senior Inspector Minal Patil, in-charge of Pune City Cyber Crime Police station.

How to avoid the new scam

Tips from the cybercrime department to avoid falling prey to scamsters:

* Do not respond to messages offering money. Any scheme offered through phones offering unusually high returns is usually a scam.

* If you respond and make payments, approach the nearest police station or cyber crime wing as soon as possible

Read full report at Indian Express dated 30-Apr-2023.