Electricity Bill Payment Fraud

According to a report by ANI, the woman who lives in Mumbai’s Andheri area received an SMS regarding an unpaid electricity bill on her husband’s phone. The SMS further warned that if the bill is not paid on time, the electricity connection of their house will be disconnected. Along with the SMS, there was also a phone number to contact for payment.

Thinking it to be a notification from the electricity department, the woman called the mentioned number. The call was picked up by an unknown person who introduced himself as an employee of the Adani Electricity office. The person further assured the victim that he would help her in bill payment and asked her to download the app “Team Viewer Quick Support.”

Following the instructions, the victim downloaded the app and shared the ID and passcode, giving the caller access to her mobile phone. After a while, the victim received back-to-back three SMS about the transactions of Rs 4,62,959, Rs 1,39,900, and Rs 89,000. A total of Rs 6,91,859 was debited from her account.

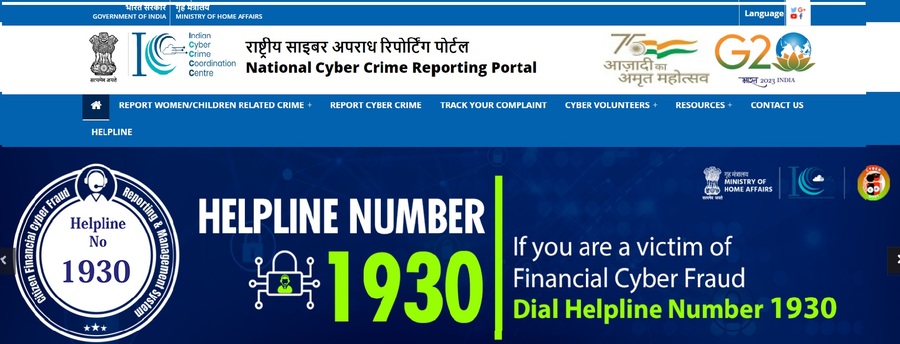

Upon seeing the large transactions, the SBI Fraud Management team also contacted the victim to verify if the recent transaction was from her side, which she denied. After finding out that she had fallen for cyber fraud, the victim went to the Andheri Police Station along with her daughter and registered an FIR about the fraud. The police have registered a case against an unknown person under sections 420, 66(C), and 66(D) of the IPC.

Similar cases have been reported in Mumbai and other parts of the country before. Scammers send SMS messages that create emergency situations, such as the discontinuation of electricity bills or the closing of bank accounts. They then share phone numbers or links for further action. Once the victim falls for the SMS and clicks on the link or makes the call, the scammers manage to gain access to the victim’s phone number or obtain an OTP to steal money directly from their bank account.

To stay safe from such scams, it is highly advisable not to click on any links attached to SMS messages received from unknown numbers. It should be noted that neither banks nor government organizations send such SMS messages or ask for any OTP or app downloads to pay an amount. If you receive a similar message over SMS or WhatsApp, delete the message, block the user, and report it to the bank or cyber cell.

Read full report from : India Today Dated 23 Mar 2023